Inconel Price Chart 2026: Trends, Forecast, Index, and Analysis

Inconel, the mighty nickel–chromium superalloys, continues to grip mainstream industrial portfolios. Its resilience under extreme conditions delivers guaranteed functionality without the slightest compromise.

And January 2026 reminded everyone of its strategic importance as the nickel price spiked to $19,000+. The surge instantly inflated pricing, forcing procurement teams to reassess budgets + supply contracts.

While the 2025 market relied on oversupply and subdued demand, 2026 indicates a gentle shift toward supply management and mounting backlogs. And this article presents more than numbers on a graph.

Inconel Pricing: Demand and Growth

Inconel demand continues to gain momentum as 2026 progresses. Aerospace backlogs, the energy sector, and advanced manufacturing directly drive the increments.

Global Industrial Growth

Turbine components and next-gen aero-engines, made from Inconel, are becoming popular. Defense programs (fighter jets, missile systems) are trying to harness Inconel’s high-temperature resistance.

Clean energy technologies are choosing Inconel for turbines, nuclear reactors, and LNG systems for long-term values. Even the corrosion resistance benefits offshore drilling and high-pressure gas pipelines.

Technological Applications

Inconel alloys (notably 625 and 718) remain at the forefront of metal 3D printing. Aerospace and energy sectors can significantly benefit from exceptional tensile strength and fatigue resistance.

Powder-bed fusion achieves complex geometries while reducing potential waste. Automotive firms are adopting Inconel 3D-printed turbocharger components to withstand extreme heat cycles.

High-performance automotive engines further have Inconel-made exhaust systems. Also, electronic brands leverage Inconel in semiconductor-making equipment for optimal thermal stability.

The aerospace Inconel blisk market is set to value $1.75B (estimated) in 2026, embracing a 5.95% CAGR. Whereas, the total investment in energy has surpassed $3.3T in 2025, with $2.2T in clean energy alone.

Knowing which Inconel (625 or 718) is the best for a project requires in-depth technical understanding. Consult VoyageMetal’s well-experienced technical team to decide on the optimal Inconel grade easily. Whether it’s an aerospace project or a 3D printing draft, our team delivers the best suggestions.

Inconel Price Analysis

Inconel isn’t a metallurgical investment like gold, silver, or diamond. So, you can understand Inconel pricing throughout recent years (2017 – 2025).

Pricing in the early years depended on nickel volatility, trade tensions, and pandemic disruptions. Meanwhile, oversupply-driven weakness in 2024 was followed by a rebound in late 2025.

A Historical Retrospective: Inconel Pricing (2017 - 2025)

- 2017–2018: Market reported nickel prices between $10,000–$13,000, supporting a rather stable pricing.

- 2019: Nickel exceeded $18,000/mt valuation in September 2019 due to Indonesia’s export ban on nickel ore.

- 2020–2021 (COVID-19): Global demand collapsed; the regional average of Ni fell below $11,000 in 2020.

- 2022–2023: Nickel pricing skyrocketed, going over $30,000 in March 2022 following the Russian invasion of Ukraine.

Market Review

- 2024: The market value was reported to be $4.38B, with an estimated CAGR (average) of 5.5% (2025–2035). Oversupply of nickel amid weak demand in the Asia-Pacific led to subdued prices.

- 2025: The average price in the US (regional divergence) reached $60,549/mt in July 2025. Aerospace OEMs began clearing backlogs steadily, driving renewed demand for the material.

Inconel Price Chart 2026: Price Index for Inconel

A price index is a statistical measure that shows the average change (%) in Inconel prices. It’s a simple tool for understanding inflation, deflation, and changes in costs relative to a base period.

Inconel prices in 2026 are trending bullish across most regions. North America and Europe are experiencing stronger growth than Asia (developed and developing), where oversupply pressures linger.

Current Price Landscape

- North America (USA): Inconel prices reached $60,549/mt in July 2025. Early 2026 trends suggest continued momentum.

- Europe (Germany): Regional average prices got to $39,385/mt in Q3 2025. 2026 forecasts point to a steady increase in defense and turbines.

- Asia (India, China, Japan): The Indian market reported $49,378/mt in September 2025, while Japan held at $54,861/mt, with volatility still in play.

- Middle East (UAE): Inconel prices hovered around $53,444/mt in late 2025. The overall pricing remains mostly supported by oil & gas.

Price Forecast and Trends (2026–2030)

Boeing and Airbus have reported higher surcharges, forcing renegotiation of long-term contracts. Anyone interested in Inconel must know what pricing movements to expect.

a. Short-Term Outlook (2026)

- Nickel Price Influence: Analysts expect Ni to remain volatile within $17,000–$20,000/mt through mid-2026.

- Aerospace Backlogs: Airbus and Boeing are tracking record demand for Inconel 625 and 718 across different components.

- Energy: European projects + Asian LNG terminals are increasing consumption in steam generators and cryogenic pipelines.

b. Medium-Term Trends (2027–2028)

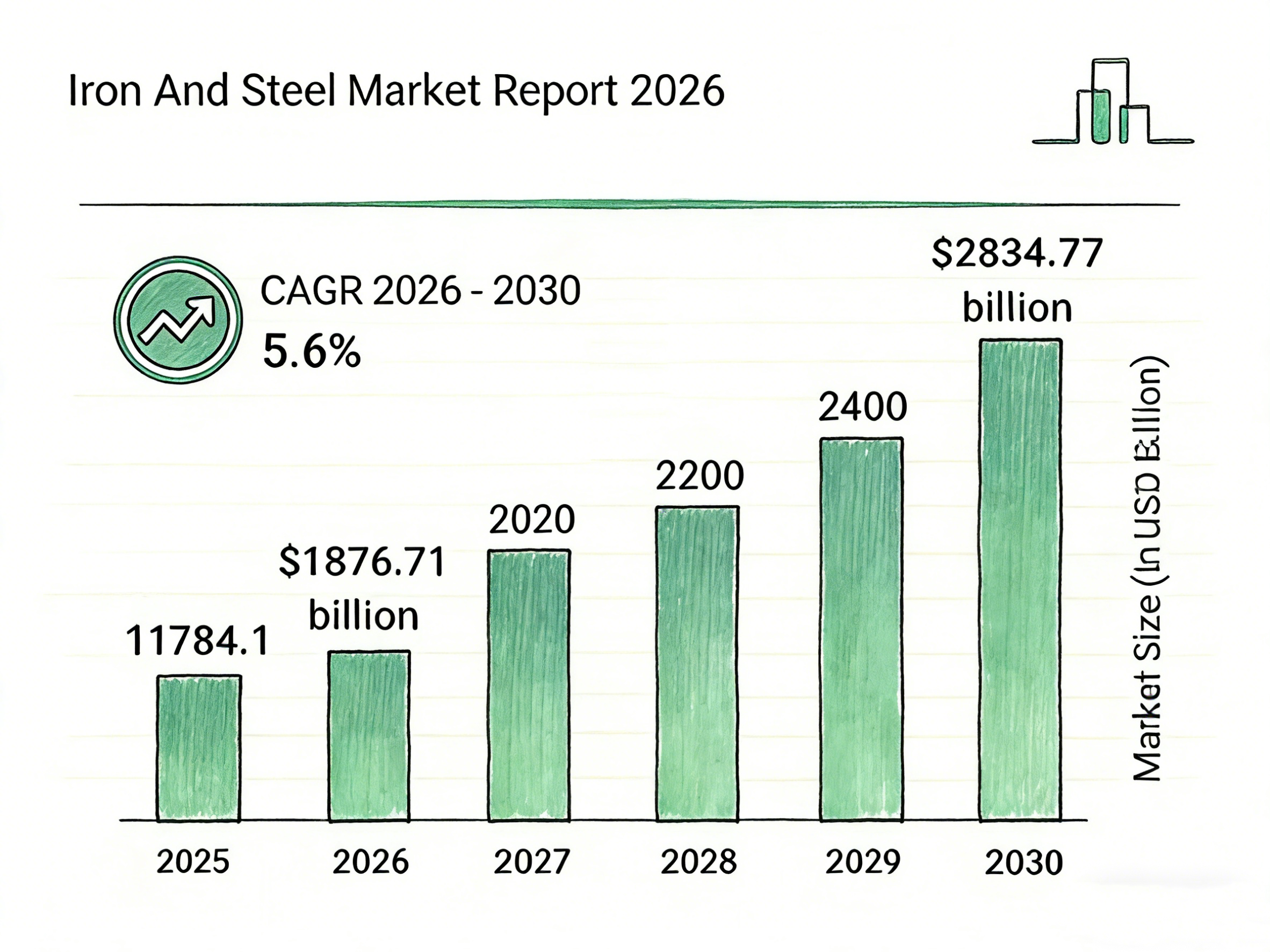

- Market Growth: The market is estimated to increase at 5.5% CAGR (2025–2035), reaching $7.5B by 2030. Regional divergence can distort the forecast to some extent.

- Technological Applications: 3D printing adoption continues to gain traction. Inconel powders enable lightweight yet high-performing designs in the aerospace/automotive industries.

c. Long-Term Forecast (2029–2030)

- Infrastructure Spending: Global programs (US, India, Middle East) will sustain demand for durable alloys.

- Trade Policy: Tariff adjustments and supply-chain localization will significantly influence regional pricing.

- Optimistic Scenario: Nickel stabilizes at around $16,000/mt, but Inconel prices grow steadily at 4%-5% annually.

- Base Scenario: Ni fluctuates between $17,000–$20,000, forcing Inconel price to rise at 5%–7% annually.

- Risk Scenario: Geopolitical shocks can push nickel pricing above $25,000, triggering sharp and double-digit increases.

Summary: Inconel Price Forecast

Year |

Nickel Price Range (USD per Metric Ton) |

Inconel Market Value (USD Billion) |

Growth Drivers |

2026 |

17,000–20,000 |

4.6 |

Aerospace backlog, nuclear projects |

2027 |

16,000–19,000 |

5.0 |

3D printing adoption, defense demand |

2028 |

17,000–20,000 |

5.4 |

Infrastructure spending, LNG expansion |

2029 |

18,000–22,000 |

6.2 |

Trade policy shifts, clean energy |

2030 |

18,000–25,000 |

7.5 |

Industrial growth, long-term valuation concerns |

Inconel’s price trajectory from 2026 onward reflects a reasonable transition. Businesses should try to anticipate price movements to consider the best possible sourcing to gain a decisive edge.

Key Factors to Drive the Price

Complex supply chain dynamics, demand-side pressures, and macroeconomic conditions drive the ongoing Inconel pricing. Each factor contributes to market volatility, requiring close monitoring.

a. Supply Chain Factors

- Nickel Volatility: Indonesia, supplying 40% of total nickel ore, influences pricing through export restrictions.

- Production Discipline: Unlike the 2025 oversupply, manufacturers are tightening output in 2026 for stable margins.

- Logistics: Rising freight rates and energy costs across Europe are adding more premiums to alloy deliveries.

b. Demand-Side Drivers

We’ve already mentioned clearing the record backlogs in the aerospace industry. To keep things clear, it means delivering a massive, accumulated, and outstanding number of ordered aircraft.

The number may surpass 17,000+ worldwide. And aircraft makers must accelerate production, resolve supply chain bottlenecks, and finalize the required certification paperwork to deliver those models.

Understandably, the demand for Inconel, especially 625 and 718, in turbine blades and exhaust systems, surged. A similar manufacturing situation has pushed for Inconel in European nuclear projects.

c. Macro-Economic Influences

The US and India’s infrastructure programs are boosting demand for durable alloys in transport and energy. Strong US dollar and inflationary pressures in Europe are influencing alloy surcharges.

Several international currencies are losing value against the USD, given geopolitical uncertainties. German procurement officers reported 5%–8% higher alloy costs due to currency fluctuations.

Strategic Stakeholder Insight: Inconel Pricing

We’ve established a reliable forecast based on the previous pricing trends and upcoming incidents. Still, geopolitical tensions, uncertainties, and conflicts can drive things crazy in no time.

And it presents quite a challenge for stakeholders to maintain profit. Each stakeholder, buyer-supplier-investor, must devise exclusive strategies to address any adversity effectively.

a. For Buyers (Procurement Officers and OEMs)

Nickel pricing has already led to alloy surcharges being raised almost everywhere. Buyers who secured contracts in late 2025 avoided the immediate spike. Time purchases around future nickel dips; monitor quarterly aerospace delivery schedules.

Long-term contracts with price adjustment clauses tied to nickel indices are becoming standard. OEMs renegotiate contracts to include surcharge caps to mitigate volatility. Negotiate dual-index contracts (Ni + energy costs) to hedge against freight and electricity premiums.

b. For Suppliers (Manufacturers and Distributors)

Disciplined supply strategies revolve around stable margins. Brands are curbing oversupply seen in 2025. In fact, Asian suppliers are balancing oversupply correction with increasing demand. Maintain regional inventory hubs to mitigate logistics risks and currency fluctuations.

c. For Investors (Metals and Industrial Markets)

The Inconel Price Index reflects nickel volatility and aerospace demand. January’s nickel spike is a clear bullish signal for alloy-linked equities. Global nickel market volume is expected to grow in 2026, with Asia-Pacific as the fastest-growing region.

Metals ETFs and aerospace equities are attractive plays. Investors tracking GE Aviation’s expansion in Inconel components see reduced production costs. Pair your nickel investments with aerospace equities to balance commodity risk.

Customers have to hedge against volatility to save budgets. Suppliers must optimize production and inventory. Meanwhile, investors must interpret price signals as indicators of industrial growth.

Final Words

The possible 2026 landscape for Inconel unfolds with the first month coming to an end. And the pricing story shouldn’t be considered numbers on the graph. Instead, refine your strategy based on forecasts and trends to hit the jackpot.

Procurement officers should pursue time purchases more aggressively, suppliers must maintain production discipline, and investors must understand potential pricing signals. Let the price chart be your compass to guide fruitful decisions for intended projects.

Best Quality Nickel Components for the Best Price at VOYAGEMETAL

VoyageMetal knows how much it takes to get a nickel project done and performing perfectly. Our 24 years of industry expertise guarantee satisfaction with a well-balanced approach from the start. Contact us to learn more about our nickel capabilities.

Frequently Asked Questions (FAQs)

- What is the current Inconel price in 2026?

As of February 2026, Inconel prices range between $15 and $50+ per kg. Although they’re estimated base prices of raw Inconel alloys. The final costs vary heavily based on form (sheet, pipe, bar, or 3D printing powder) as well as the specific technical specifications.

- What factors are driving Inconel demand?

Aerospace (jet engines, turbine blades), energy (nuclear reactors, LNG pipes), auto (turbochargers, exhaust), and electronics (semiconductor equipment) are leading the charge.

- How does the Inconel Price Index work?

The price index for Inconel consolidates raw material costs (nickel), alloy surcharges, and demand-side pressures. Buyers, suppliers, and investors can track momentum to negotiate contracts effectively.

- What is the forecast for Inconel prices through 2030?

The Inconel market is expected to grow at a 5.5% CAGR (2025–2035), reaching $7.5B by 2030. Pricing is expected to rise steadily, with risks including nickel volatility and geopolitical shocks.

- How does 3D printing influence Inconel prices?

Additive manufacturing with Inconel powders reduces waste by up to 90%. Aerospace and automotive firms with 3D-printed components are creating new demand streams that drive long-term pricing.

- What signals should investors watch in the Inconel market?

Investors should track nickel futures, aerospace order books, and energy project pipelines. Metals ETFs and aerospace equities should lead the board, given the surging demand and disciplined supply.

- Why does the price of Inconel matter for businesses/investors?

The chart isn’t a technical metric; it indicates industrial momentum. Businesses anticipate procurement costs and manage risk from the chart. They can align investment strategies with the growth trends.